The battle over what silicon should power the next generation of AI-enhanced 5G networks is heating up, and Ericsson just made its position crystal clear: you don’t need Nvidia to do AI-RAN. Two Nordic Giants, Two Very Different Strategies The 5G radio access network (RAN) equipment market is at a crossroads. As artificial intelligence becomes […]

KORE Wireless Acquired for $726M: What This IoT Going-Private Deal Means

KORE Group Holdings (NYSE: KORE), one of the largest independent IoT connectivity providers in the world, announced today that it has agreed to be acquired by private equity firms Searchlight Capital Partners and Abry Partners in an all-cash deal valued at approximately $726 million. Under the agreement, shareholders will receive $9.25 per share, and KORE […]

Taoglas TG.66 Series Review: The World’s Smallest 5G Antenna, Tested by 5Gstore

Summary: The Taoglas TG.66 is the world’s smallest 5G terminal mount antenna, covering the full 600 MHz to 6 GHz spectrum in a form factor barely larger than your thumb. We tested it at 5Gstore by replacing the larger stock antennas on several routers, and the TG.66 outperformed them. We also recommend swapping in the TG.66 […]

Starlink Cuts Prices and Offers Free Hardware to Distribution Partners: What It Means for Rural Internet Customers

Table of Contents SpaceX’s Starlink satellite internet service is making aggressive moves to expand its customer base, and the timing is hard to ignore. The company is now offering free hardware to distribution partners and cutting monthly service rates across multiple markets, a strategy CEO Elon Musk says is entirely about affordability — not competition. […]

AirLink OS 6.0 Now Available: What’s New for Your AirLink Router?

Semtech has released AirLink OS 6.0.0, a major new firmware version built exclusively for the new AirLink EX400 and RX400 5G RedCap routers. This isn’t just a point release — it’s the foundation for Semtech’s next generation of AirLink OS-powered industrial and commercial IoT routers, introducing a redesigned user interface, smarter cellular management, enhanced VPN configuration, and dozens […]

Peplink Is Going to Nasdaq: What the Plover Bay Spinoff Means

If you follow the networking world, and especially if you’re a Peplink user, you probably saw the big news today. Plover Bay Technologies (SEHK: 1523), the Hong Kong-listed parent company behind Peplink, has officially announced plans to spin off Peplink Holdings Ltd. as a separately listed company on the Nasdaq stock exchange. The transaction has […]

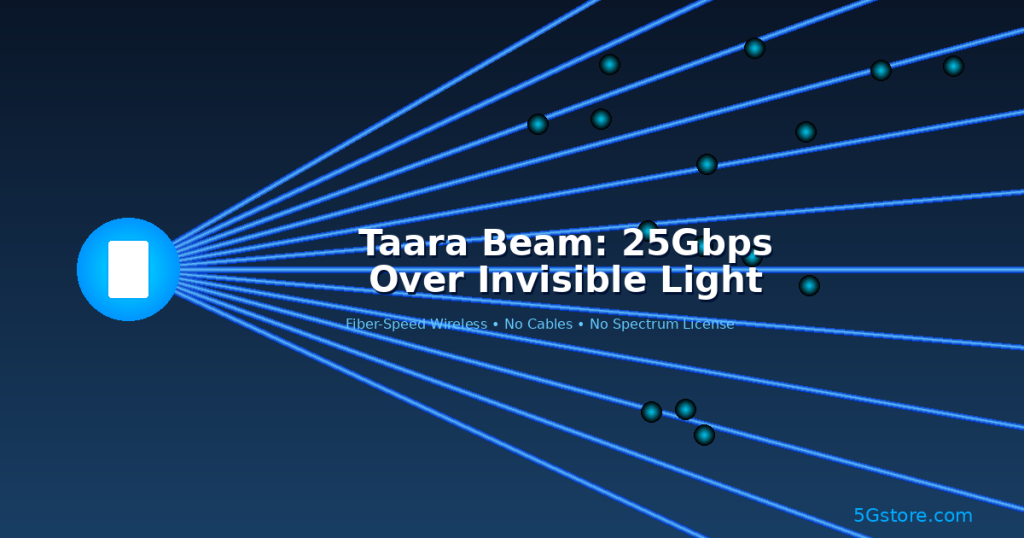

Taara Beam: This Shoebox-Sized Device Delivers 25Gbps Internet Using Invisible Beams of Light

What if you could get fiber-speed internet without laying a single cable? That’s the promise behind the Taara Beam, a compact wireless device that transmits data at up to 25Gbps using invisible near-infrared light — the same type of light used inside fiber optic cables, but sent through open air instead. Taara, which spun out of […]

Managed vs Unmanaged Switches: How to Choose the Right Network Switch (and Avoid Overbuying)

Network switches are one of those “silent heroes” of a reliable setup. When everything works, nobody thinks about them. But when a camera drops offline, a VoIP call turns choppy, or a remote site becomes impossible to troubleshoot, the switch suddenly becomes the most important device in the room. If you’re shopping for a switch, […]

AirLink Manager 2.18 Upgrade Required Before Google Maps Authentication Deadline

Semtech (formerly Sierra Wireless) has issued an important product bulletin that affects customers using AirLink Manager (AM) and AirLink Mobility Manager (AMM). If you are running an on-premise deployment, the AirLink Manager 2.18 upgrade is required before May 31, 2026 to avoid a significant disruption in map-related functionality. Because this change directly impacts tracking, reporting, […]

5Gstore Tech Corner: Fixing Asymmetric Routing with SpeedFusion + FusionHub Using Outbound Policy NAT

Every now and then, we run into a networking issue that isn’t caused by “bad VPN settings” or a broken firewall rule. Instead, it’s caused by something much sneakier: asymmetric routing. In this Tech Corner post, we’re walking through a real scenario involving: We’ll cover why the problem happens, what it looks like in packet captures, […]